To the Congress:

The budget of the United States Government for the fiscal year ending June 30, 1942, which I transmit herewith, is a reflection of a world at war. Carrying out the mandate of the people, the Government has embarked on a program for the total defense of our democracy. This means warships, freighters, tanks, planes, and guns to protect us against aggression; and jobs, health, and security to strengthen the bulwarks of democracy. Our problem in the coming year is to combine these two objectives so as to protect our democracy against external pressure and internal slackness.

The threatening world situation forces us to build up land, sea, and air forces able to meet and master any contingency. It is dangerous to prepare for a little defense. It is safe only to prepare for total defense.

Total defense means more than weapons. It means an industrial capacity stepped up to produce all the materiel for defense with the greatest possible speed. It means people of health and stamina, conscious of their democratic rights and responsibilities. It means an economic and social system functioning smoothly and geared to high-speed performance. The defense budget, therefore, must go beyond the needs of the Army and Navy.

It is not enough to defend our national existence. Democracy as a way of life is equally at stake. The ability of the democracies to employ their full resources of manpower and skill and plant has been challenged. We meet this challenge by maximum utilization of plant and manpower and by maintaining governmental services, social security, and aid to those suffering through no fault of their own. Only by maintaining all these activities can we claim the effective use of resources which our democratic system is expected to yield, and thus justify the expenditures required for its defense.

THE NATIONAL PROGRAM

In this Budget I am presenting a program for 1942, carefully worked out to combine these objectives. This program, including defense and non-defense activities, will cost about 17.5 billions of dollars. For the same period, we expect the largest national income for the Nation as a whole and also the largest tax receipts.

In addition to, but essentially and rightly as a complement to this program, the time has come for immediate consideration of assuring the continuation of the flow of vitally necessary munitions to those nations which are defending themselves against attack and against the imposition of new forms of Government upon them.

Such a complementary program would call for appropriations and contract authorizations over and above this Budget. The sum of all these defense efforts should be geared to the productive capacity of this Nation expanded to literally its utmost efforts.

THE DEFENSE PROGRAM AND DEFENSE EXPENDITURES

Sixty-two per cent of the expenditures proposed in this Budget are for national defense. No one can predict the ultimate cost of a program that is still in development, for no one can define the future. When we recall the staggering changes in the world situation in the last six months, we realize how tentative all present estimates must be.

These expenditures must be seen as a part of a defense program stretching over several years. On the basis of the appropriations and authorizations enacted for national defense from June, 1940, up to the present time, plus the recommendations for supplementary appropriations and authorizations for 1941 and the recommendations contained in this Budget for 1942, we have a program of 28 billion dollars.

This is a vast sum, difficult to visualize in terms of work actually to be done. If we can prove that we are able to organize and execute such a gigantic program in a democratic way, we shall have made a positive contribution in a world in which the workability of democracy is challenged.

This defense program is summarized below:

Appropriations, authorizations, and recommendations (June, 1940, 1941 1942)

[In millions of dollars]

Army $13,704

Navy 11,587

Expansion of industrial plant 1,902

Other defense activities 1,287

Total $28,480

|

The Army funds provide for the training and maintenance of a force of men increasing from 250,000 in June, 1940, to 1,400,000 in 1942, equipped with the most modern devices of motorized and mechanical warfare. The Navy estimates continue the construction of our over-all Navy and contemplate the doubling of naval personnel. There is provision for a great increase in the number of Army and Navy planes and for training pilots, technicians, and ground crews. |

Behind the lines a whole new defense industry is being built with the financial support of the Federal Government. One hundred and twenty-five new plants are under contract; more are planned.

In submitting these recommendations, I have not covered the full requirements of the civilian training program. At present, surveys are under way which will provide a basis for transmitting an estimate of funds needed for the extension of this essential defense activity. In the current fiscal year, over a million men and women are included in the various programs of apprentice training, vocational training in trade schools and engineering colleges, work-experience shops, and pilot training.

Expenditures under the defense program during the last six months amount to 1,750 million dollars, This is two and onehalf times the amount spent for national defense in the same period of the fiscal year 1940. However, these expenditures understate the progress already made. In six months, contracts and orders for 10 billion dollars have been placed. This means that in addition to present defense production, all over the country more factories, large and small, are getting ready rapidly to increase production. Once these preparations have been completed, actual deliveries and expenditures will be greatly accelerated.

I expect actual expenditures to be stepped up to four and three-quarter billion dollars in the six months ending June, 1941, and to almost 11 billion in the fiscal year 1942. We shall actually expend more than 25 billion dollars for defense within a 3-year period. This can be accomplished, but only if management, labor, and consumers cooperate to the utmost.

NON-DEFENSE EXPENDITURES

The increased military expenditures permit a substantial reduction in non-defense expenditures, particularly for those activities which are made less necessary by improved economic conditions. Obligations such as interest, pensions, and insurance benefits are fixed. Almost as fixed are the appropriations for which the Congress has already made legislative commitments-security grants to the States, Federal aid for highways, the 30 per cent of tariff revenue set aside for reducing agricultural surpluses, and similar items. Together, these fixed items make up nearly half of the non-defense expenditures I am proposing for the fiscal year 1942. For the items subject to administrative rather than legislative action, I have been able to reduce expenditures by 600 million dollars or 15 per cent. This reduction and its relation to total expenditures are shown below:

Certain reductions are possible in carrying out the established policies relating to public works and relief, but little change can be made in the regular operating costs of Government. As I indicated in my Budget Message last year, the operating costs of the regular departments are already down to the bedrock of the activities and functions ordered by the Congress. In spite of the defense pressure on many of these regular programs, expenditures will be kept below the level of the current year.

Expenditures Estimated in millions

of dollars Per cent

change

1942 1941

Defense program $10,811 $6,464 +67

Fixed commitments 3196 2,984 +7

Other activities 3,478 4,094 —15

Total (excluding returns from

Government corporations) 17,485 13,542 +29

|

SOCIAL AND ECONOMIC PROGRAMS |

It is our policy to retain the ideals and objectives of our social and economic programs in the face of war changes. The costs of those programs affected by economic activity are flexible. Because of the defense effort some of these programs can be carried on at a lower cost. In other cases, no curtailment is possible without sacrificing our objectives.

We should realize, however, that even with a fully functioning defense effort there will remain special areas of need and that social security, agricultural benefits, and work relief contribute to total defense in terms of the health and morale of our people.

Social-security programs.—I recommend the continuance in full measure of the social-security programs. This includes not only the payment of old-age benefits as required by law but also aid to youth and continued payments toward the State aid of old persons not covered by the insurance benefits; aids to children and to the physically handicapped. In total, these services will require approximately the same expenditure as in the current fiscal year, except for some increase in grants to the States as required by law.

Furthermore, I deem it vital that the Congress give consideration to the inclusion in the old-age and survivors insurance system and the unemployment compensation system of workers not now covered.

Agricultural programs.—The increased domestic market for farm products, resulting from defense expenditure, will improve the income position of many farmers. At the same time the curtailment of foreign markets, particularly in cotton, wheat, and tobacco, would leave large numbers of these farmers in a serious plight without the continuance of the farm programs. After weighing both of these factors, I estimate a reduction of 45 million dollars in the agricultural programs. We are definitely maintaining the principles of parity and soil conservation.

Public works.—During this period of national emergency it seems appropriate to defer construction projects that interfere with the defense program by diverting manpower and materials. Further, it is very wise for us to establish a reservoir of post defense projects to help absorb labor that later will be released by defense industry.

With this in mind, I am recommending reductions for rivers and harbors and flood-control work. Where possible, without placing the projects or the water users thereof in jeopardy, reductions are proposed in the expenditures for reclamation projects. I have requested that further contracts for the construction of public buildings outside the District of Columbia be held in abeyance for the present. On the other hand, I have recommended funds for power and other projects considered essential to national defense.

Projects under construction, or on which bids have been solicited, will go forward to completion. Throughout the Federal service other projects are being deferred until a more appropriate time. However, surveys and the planning of new projects will go forward so that construction can be resumed without delay. This will produce a long list of public work projects, apart from defense construction, arranged according to priorities. Such a list could be submitted to a future Congress for the appropriation of funds to put it into operation.

Work Projects Administration.- The defense program has already resulted in a substantial increase in production, employment, and national income. Although industrial production is now running 20 per cent above the average level of 1929, there are still many persons either unemployed, or employed as emergency workers, or incapable of steady employment.

The defense program will lead to further reemployment, and also to a further increase in the labor force and to a shift from part-time to full-time or over-time employment. But even under the full defense program we cannot expect full absorption of the labor force because some people just cannot be fitted into the picture. There will be some localities with a labor shortage at the same time that others have a labor surplus. There will be shortages of particular skills and aptitudes at the same time that others are in surplus.

I recommend an appropriation of 995 million dollars for work relief for the full fiscal year. This is 400 million dollars less than the amount required for the present fiscal year. It will not be necessary to use this full amount if the defense program should result in a more general reemployment than is presently indicated. The expenditure can also be reduced if employers will contribute by hiring unskilled or semi-skilled or older workers for those jobs where special skills are not required.

We must face the fact that even with' what we call "full employment" there will remain a large number of persons who cannot be adjusted to our industrial life. For this group, the Government must provide work opportunities.

FINANCING THE NATIONAL PROGRAM

Estimates of expenditures and revenue compared.- The defense program dominates not only the expenditure side of the Budget, but influences also the expected revenue. Economic activities and national income are rising to record heights. From a higher national income a greater revenue will flow, although in the case of most taxes there is, of course, a time lag. The revenue for the fiscal year 1941 will reflect some of the increase in defense activities; the revenue for the fiscal year 1942 will be affected to a larger extent; but the full impact will not be felt before the fiscal year 1943.

The revenue for the fiscal year 1942 is expected to be 9 billion dollars. It will exceed the revenue collected in the fiscal year 1940—the last year before the start of the present defense program—by 3 billion dollars. One-half of this increase will come from the defense taxes already enacted by the Congress, the other half from the increase in national income.

The revenue expected for 1942 will be 1.6 billions larger than the total of all non-defense expenditures. This 1.6 billions is greater than the annual expenditure on defense before the present program started, but less than will be necessary for maintaining the Army and Navy at the new level.

Estimates of receipts for 1942 and 1941 are set forth below:

Estimated in millions

of dollars

Receipts Per cent

change

1942 1941

Progressive taxes on individuals

and estates $1,979 $1,571 +26

Profit and capital taxes on corporations 2,839 1,745 +63

Customs, excise, stamp, and

miscellaneous taxes 2,7562, 657 +4

Employment taxes for Federal

old-age and survivors insurance 725 668 +9

Other employment taxes 243 230 +6

Miscellaneous receipts

(including back income taxes). 429 422 +2

Total receipts (excluding returns

from Government corporations) 8,971 7,293 +23

Deduct net appropriation for

Federal old-age and survivors

insurance trust fund 696 640 +9

Net receipts (excluding returns

from Government corporations) 8,275 6,653 +24

|

Under present tax laws, deficits of 6.2 billion dollars in 1941 and 9.2 billion dollars in 1942 may be expected. The calculations follow: |

Estimated in millions

of dollars

Summary

1942 1941

Expenditures $17,485 $13,542

Receipts 8,275 6,653

Excess of expenditures over receipts 9,210 6,889

Less return of surplus funds

from Government corporations 700

Deficit 9,210 6,189

In presenting the above calculations, I am assuming that the Congress will accept the recommendation of the Secretary of the Treasury that the earmarking of taxes for retirement of defense obligations be repealed; and the proposal of the Postmaster General that the 3-cent rate on first-class postage be continued.

Tax policy.—There is no agreement on how much of such an extraordinary defense program should be financed on a pay-asyou-go basis and how much by borrowing. Only very drastic and restrictive taxation which curtails consumption would finance defense wholly on a pay-as-you-go basis. I fear that such taxation would interfere with the full use of our productive capacities. We have a choice between restrictive tax measures applied to the present national income and a higher tax yield from increased national income under less restrictive tax measures. I suggest, therefore, a financial policy aimed at collecting progressive taxes out of a higher level of national income. I am opposed to a tax policy which restricts general consumption as long as unused capacity is available and as long as idle labor can be employed.

We cannot yet conceive the complete measure of extraordinary taxes which are necessary to pay off the cost of emergency defense and to aid in avoiding inflationary price rises which may occur when full capacity is approached.

However, a start should be made this year to meet a larger percentage of defense payments from current tax receipts. The additional tax measures should be based on the principle of ability to pay. Because it is the fixed policy of the Government that no citizen should make any abnormal net profit out of national defense, I am not satisfied that existing laws are in this respect adequate.

I hope that action toward these ends will be taken at this session of the Congress.

I see many ways in which our tax system can be improved without resort to restrictive tax levies. By adjustments in the existing tax laws the present rates of progressive taxation could be made fully effective, as I believe the Congress intended.

We must face the fact that the continued maintenance of an expanded Army and Navy and the interest on our defense debt will call for large Federal expenditures in the years ahead. Our tax system must be made ready to meet these requirements.

I am as much concerned about our long-run need for an improved tax system as I am about the immediate necessity of financing the defense program.

I have often expressed my belief that no really satisfactory tax reform can be achieved without readjusting the Federal-State-local fiscal relationship. I urge a thorough investigation of the possibilities of a comprehensive tax reform; I propose that meanwhile we make all possible progress in improving the Federal tax system.

Borrowing.- A substantial part of the defense program must, of course, be financed through borrowing. Individual investors will be given increased opportunities to contribute their share toward defense through the purchase of Government securities. Such borrowing is not hazardous as long as it is accompanied by tax measures which assure a sufficient tax yield in the future. This raises the question of the debt limit. The Congress, by making appropriations and levying taxes, in fact, controls the size of the debt regardless of the existence of a statutory debt limit. If the Congress, subsequent to the establishment of a statutory debt limit, makes appropriations and authorizations which require borrowing in excess of that limit, it has, in effect, rendered that prior limit null and void. In the first 130 years of our national life, the Congress controlled the debt successfully without requiring such a limit. In view of these facts, I question the significance of a statutory debt limit, except as it serves as a fiscal monitor.

The fiscal policy outlined here would be in accord with our objective of financing the defense program in an equitable manner, facilitating full use of our national resources, and avoiding inflationary policies which would aggravate the problems of post-defense adjustment.

The debt problem.—For more than 25 years the world has been in a state of political turmoil and its economies have been out of balance. This world condition is reflected in unbalanced budgets in all countries. Here, the first World War, the war against the depression, the present defense program, all resulted in large additions to the Federal debt.

I understand the concern of those who are disturbed by the growth of the Federal debt. Yet the main fiscal problem is not the rise of the debt, but the rise of debt charges in relation to the development of our resources.

The fight for recovery raised national income by more than 30 billion dollars above the depression depth. In the same period the total annual Federal interest charges increased by 400 million dollars. Even if these interest charges increase, they can scarcely present a serious fiscal problem so long as a high level of national income can be maintained.

Investors are fully aware of this fact. The bonds of the United States Government are the safest securities in the world because they are backed by the best asset in the world—the productive capacity of the American people. Our tax burden is still moderate compared to that of most other countries.

It should be borne in mind that our national debt results from wars and the economic upheavals following war. These conditions are not of our own making. They have been forced upon us. The national debt of almost all nations would be far lower today if competitive armaments had not existed during the past quarter of a century. If this war should be followed, as I hope it will, by peace in a world of good neighbors, then the complete elimination of competitive armaments will become possible. Only in such a world can economic stability be restored.

If a high level of economic activity can be maintained during the defense period and what will be a more difficult task-maintained in the post-defense period, then the fiscal needs can be readily met.

The Budget of the United States presents our national program. It is a preview of our work plan, a forecast of things to come. It charts the course of the Nation.

The necessity for loading the present Budget with armament expenditures is regretted by every American. A wry turn of fate places this burden of defense on the backs of a peace-loving people.

We can meet the demands of armament because we are a people with the will to defend and the means to defend. The boundaries of our productive capacity have never been set.

The whole program set forth in this Budget has been prepared at a time when no man could see all the signposts ahead. One marker alone stands out all down the road. That marker carries not so much an admonition as a command to defend our democratic way of life.

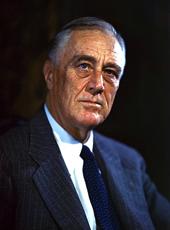

Franklin D. Roosevelt, Annual Budget Message Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/210616