Today I have signed into law S. 543, the "Federal Deposit Insurance Corporation Improvement Act of 1991." This legislation falls far short of the truly comprehensive reform proposal that my Administration sent to the Congress early this year. Our proposal squarely addressed the fundamental problems of the banking industry -- the need to recapitalize the Bank Insurance Fund; the need to make banks safer, stronger, and more competitive; the need to attract private capital into the industry; and the need to protect the taxpayer from a costly deposit insurance bailout.

Unfortunately, the narrow legislation produced by the Congress does little more than provide critical funding to the Bank Insurance Fund. While it includes some of the regulatory reforms we proposed last February, it does nothing to restore the competitiveness of the banking industry. While it demands that banks increase capital and pay higher deposit insurance premiums, it gives no additional tools to banks to meet these demands. This shortsighted congressional response to the problems we face increases taxpayer exposure to bank losses. The Congress must shoulder its responsibility for not adopting proposals to make banks stronger and more competitive. The Congress must also assume responsibility for exacerbating the "credit crunch" that has restrained banks from lending to even their best customers.

Certain provisions of S. 543 present constitutional difficulties. Two provisions could be construed to infringe upon my constitutional responsibility to supervise my subordinates and to ensure that the executive branch speaks with one voice. Sections 215(b) and 421(c) contemplate that certain executive agencies may present views differing from those of the Administration in reports to the Congress. I shall interpret these provisions in a manner consistent with my constitutional authority, as head of a unitary executive branch, to resolve disputes among my subordinates before their views are presented to the Congress.

Section 305(b)(2) could be construed to require certain Federal banking agencies to discuss revisions of capital standards for insured depository institutions with the Bank for International Settlements, based in Switzerland. I will construe section 305(b)(2) in a manner consistent with my constitutional authority to conduct the international relations of the United States.

I have decided to sign this legislation today because of the critical need to replenish the Bank Insurance Fund. But I call on the Congress to ignore the pleadings of special interests that have stalled truly comprehensive banking reform. The Congress still has our legislative proposal, and we stand ready, willing, and able to work for comprehensive reform. It is now up to the Congress to address squarely next year the problems that it could not come to grips with in the legislation before me today. The taxpayers deserve no less.

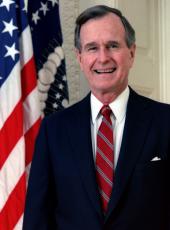

George Bush

The White House,

December 19, 1991.

Note: S. 543, approved December 19, was assigned Public Law No. 102 - 242.

George Bush, Statement on Signing the Federal Deposit Insurance Corporation Improvement Act of 1991 Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/266227