To the Congress:

As the fiscal year draws to its close it becomes our duty to consider the broad question of tax methods and policies. I wish to acknowledge the timely efforts of the Congress to lay the basis, through its committees, for administrative improvements, by careful study of the revenue systems of our own and of other countries. These studies have made it very clear that we need to simplify and clarify our revenue laws.

The Joint Legislative Committee, established by the Revenue Act of 1926, has been particularly helpful to the Treasury Department. The members of that Committee have generously consulted with administrative officials, not only on broad questions of policy but on important and difficult tax cases.

On the basis of these studies and of other studies conducted by officials of the Treasury, I am able to make a number of suggestions of important changes in our policy of taxation. These are based on the broad principle that if a government is to be prudent its taxes must produce ample revenues without discouraging enterprise; and if it is to be just it must distribute the burden of taxes equitably. I do not believe that our present system of taxation completely meets this test. Our revenue laws have operated in many ways to the unfair advantage of the few, and they have done little to prevent an unjust concentration of wealth and economic power.

With the enactment of the Income Tax Law of 1913, the Federal Government began to apply effectively the widely accepted principle that taxes should be levied in proportion to ability to pay and in proportion to the benefits received. Income was wisely chosen as the measure of benefits and of ability to pay. This was, and still is, a wholesome guide for national policy. It should be retained as the governing principle of Federal taxation. The use of other forms of taxes is often justifiable, particularly for temporary periods; but taxation according to income is the most effective instrument yet devised to obtain just contribution from those best able to bear it and to avoid placing onerous burdens upon the mass of our people.

The movement toward progressive taxation of wealth and of income has accompanied the growing diversification and interrelation of effort which marks our industrial society. Wealth in the modern world does not come merely from individual effort; it results from a combination of individual effort and of the manifold uses to which the community puts that effort. The individual does not create the product of his industry with his own hands; he utilizes the many processes and forces of mass production to meet the demands of a national and international market.

Therefore, in spite of the great importance in our national life of the efforts and ingenuity of unusual individuals, the people in the mass have inevitably helped to make large fortunes possible. Without mass cooperation great accumulations of wealth would 'be 'impossible save by unhealthy speculation. As Andrew Carnegie put it, "Where wealth accrues honorably, the people are · always silent partners." Whether it be wealth achieved through the cooperation of the entire community or riches gained by speculation—in either case the ownership of such wealth or riches represents a great public interest and a great ability to pay.

I My first proposal, in line with this broad policy, has to do with inheritances and gifts. The transmission from generation to generation of vast fortunes by will, inheritance, or gift is not consistent with the ideals and sentiments of the American people.

The desire to provide security for oneself and one's family is natural and wholesome, but it is adequately served by a reasonable inheritance. Great accumulations of wealth cannot be justified on the basis of personal and family security. In the last analysis such accumulations amount to the perpetuation of great and undesirable concentration of control in a relatively few individuals over the employment and welfare of many, many others.

Such inherited economic power is as inconsistent with the ideals of this generation as inherited political power was inconsistent with the ideals of the generation which established our Government.

Creative enterprise is not stimulated by vast inheritances. They bless neither those who bequeath nor those who receive. As long ago as 1907, in a message to Congress, President Theodore Roosevelt urged this wise social policy:

"A heavy progressive tax upon a very large fortune is in no way such a tax upon thrift or industry as a like tax would be on a small fortune. No advantage comes either to the country as a whole or to the individuals inheriting the money by permitting the transmission in their entirety of the enormous fortunes which would be affected by such a tax; and as an incident to its function of revenue raising, such a tax would help to preserve a measurable equality of opportunity for the people of the generations growing to manhood."

A tax upon inherited economic power is a tax upon static wealth, not upon that dynamic wealth which makes for the healthy diffusion of economic good.

Those who argue for the benefits secured to society by great fortunes invested in great businesses should note that such a tax does not affect the essential benefits that remain after the death of the creator of such a business. The mechanism of production that he created remains. The benefits of corporate organization remain. The advantages of pooling many investments in one enterprise remain. Governmental privileges such as patents remain. All that are gone are the initiative, energy and genius of the creator—and death has taken these away.

I recommend, therefore, that in addition to the present estate taxes, there should be levied an inheritance, succession, and legacy tax in respect to all very large amounts received by any one legatee or beneficiary; and to prevent, so far as possible, evasions of this tax, I recommend further the imposition of gift taxes suited to this end.

Because of the basis on which this proposed tax is to be levied and also because of the very sound public policy of encouraging a wider distribution of wealth, I strongly urge that the proceeds of this tax should be specifically segregated and applied, as they accrue, to the reduction of the national debt. By so doing, we shall progressively lighten the tax burden of the average taxpayer, and, incidentally, assist in our approach to a balanced budget.

II The disturbing effects upon our national life that come from great inheritances of wealth and power can in the future be reduced, not only through the method I have just described, but through a definite increase in the taxes now levied upon very great individual net incomes.

To illustrate: The application of the principle of a graduated tax now stops at $1,000,000 of annual income. In other words, while the rate for a man with a $6,000 income is double the rate for one with a $4,000 income, a man having a $5,000,000 annual income pays at the same rate as one whose income is $1,000,000.

Social unrest and a deepening sense of unfairness are dangers to our national life which we must minimize by rigorous methods. People know that vast personal incomes come not only through the effort or ability or luck of those who receive them, but also because of the opportunities for advantage which Government itself contributes. Therefore, the duty rests upon the Government to restrict such incomes by very high taxes.

III In the modern world scientific invention and mass production have brought many things within the reach of the average man which in an earlier age were available to few. With large-scale enterprise has come the great corporation drawing its resources from widely diversified activities and from a numerous group of investors. The community has profited in those cases in which large-scale production has resulted in substantial economies and lower prices.

The advantages and the protections conferred upon corporations by Government increase in value as the size of the corporation increases. Some of these advantages are granted by the State which conferred a charter upon the corporation; others are granted by other States which, as a matter of grace, allow the corporation to do local business within their borders. But perhaps the most important advantages, such as the carrying on of business between two or more States, are derived through the Federal Government. Great corporations are protected in a considerable measure from the taxing power and regulatory power of the States by virtue of the interstate character of their businesses. As the profit to such a corporation increases, so the value of its advantages and protection increases.

Furthermore, the drain of a depression upon the reserves of business puts a disproportionate strain upon the modestly capitalized small enterprise. Without such small enterprises our competitive economic society would cease. Size begets monopoly. Moreover, in the aggregate these little businesses furnish the indispensable local basis for those nationwide markets which alone can ensure the success of our mass production industries. Today our smaller corporations are fighting not only for their own local well-being but for that fairly distributed national prosperity which makes large-scale enterprise possible.

It seems only equitable, therefore, to adjust our tax system in accordance with economic capacity, advantage and fact. The smaller corporations should not carry burdens beyond their powers; the vast concentrations of capital should be ready to carry burdens commensurate with their powers and their advantages.

We have established the principle of graduated taxation in respect to personal incomes, gifts and estates. We should apply the same principle to corporations. Today the smallest corporation pays the same rate on its net profits as the corporation which is a thousand times its size.

I, therefore, recommend the substitution of a corporation income tax graduated according to the size of corporation income in place of the present uniform corporation income tax of 13 3/4 percent. The rate for smaller corporations might well be reduced to 10 3/4 percent, and the rates graduated upward to a rate of 16 3/4 percent on net income in the case of the largest corporations, with such classifications of business enterprises as the public interest may suggest to the Congress.

Provision should, of course, be made to prevent evasion of such graduated tax on corporate incomes through the device of numerous subsidiaries or affiliates, each of which might technically qualify as a small concern even though all were in fact operated as a single organization. The most effective method of preventing such evasions would be a tax on dividends received by corporations. Bona fide investment trusts that submit to public regulation and perform the function of permitting small investors to obtain the benefit of diversification of risk may well be exempted from this tax.

In addition to these three specific recommendations of changes in our national tax policies, I commend to your study and consideration a number of others. Ultimately, we should seek through taxation the simplification of our corporate structures through the elimination of unnecessary holding companies in all lines of business. We should likewise discourage unwieldy and unnecessary corporate surpluses. These complicated and difficult questions cannot adequately be debated in the time remaining in the present Session of this Congress.

I renew, however, at this time the recommendations made by my predecessors for the submission and ratification of a Constitutional Amendment whereby the Federal Government will be permitted to tax the income on subsequently issued State and local securities, and whereby State and local governments will be permitted to tax the income on future issues of Federal securities.

In my Budget Message of January 7th, I recommended that the Congress extend the miscellaneous internal revenue taxes which are about to expire and also maintain the current rates of those taxes which, under the present law, would be reduced. I said then that I considered such taxes necessary to the financing of the Budget for 1936. I am gratified that the Congress is taking action on this recommendation.

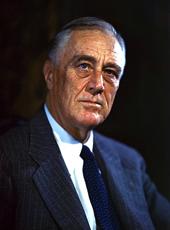

Franklin D. Roosevelt, Message to Congress on Tax Revision. Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/208848